The Anderson Wilde & Harris team always have a finger on the pulse of the property market, making sure we stay abreast of any fluctuations in the market in order to provide our clients with up-to-date advise and guidance. We work closely with the RICS, sponsoring their Quarterly Chartbook and providing expert analysis on the state of the market.

Below you will find some of the analysis included within the latest quarterly update, which was published a couple of weeks ago.

An overall economic summary

Following a long period of low interest rates, the aim of which was to help UK business and households manage any disruption arising from the pandemic, The Bank of England began the process of raising interest rates in the middle June 2022. This started with an increase of a quarter percent to 1.25% followed by further, steady increases over the last couple of months.

Interest rates have been increased by The Bank of England to help counter the recent rise in inflation, which has seen it reach a 40-year high, well above the target of 2%.

As at the middle of July 2022, inflation rate was 9.1% and is anticipated this will continue to rise, which could result in a substantial impact on the economy as a whole.

At the start of the year inflation rate was largely below 1%. The Bank of England have forecast that while they expect inflation to rise further in the coming months, they also expect it to fall back to the target within two years’ time.

The Monetary Policy Report released in May 2022 noted that higher energy and goods prices, especially those purchased abroad, are the main causes of the increase in inflation. They expect inflation to rise to around 10% this year and the economy to slow.

As Covid restrictions eased in many countries, people started to spend more. However, suppliers have encountered problems getting enough product to sell to customers, which has led to higher prices – particularly for imported goods. As we have seen, higher energy prices have also played a major role with large increases in oil and gas prices pushing petrol prices and energy bills upwards.

The impact on the property market

While agency contacts in some sectors, such as business services as well as some manufacturers, have continued to report strong demand, their output growth has been constrained by shortages of goods and labour. However, we are also seeing signs of the squeezing of real household incomes starting to weigh on demand, for example for consumer goods and for house purchases.

Construction output growth weakened modestly as rising materials costs and labour shortages caused projects to be delayed or cancelled. While delays and cancellations were most commonly reported for commercial projects, housebuilding activity has also been held back through planning delays.

By contrast, construction of public and private infrastructure – as well as health and education projects – had not been as affected to the same degree. Demand for the construction or refurbishment of office space also remained robust, supported by demand for premises that meet environmental requirements and are suitable for hybrid working. Construction of warehousing and data centres also remained strong.

During the quarter, demand for housing remained strong, but supply has started to increase in the owner-occupier market. Contacts reported a modest increase in the availability of properties for sale across the UK, with instructions to sell picking up, and house price inflation starting to moderate in some areas. These contacts expected house price inflation to continue to slow over the coming months as the squeeze on real household incomes weighs on confidence. However, demand for rental properties continued to exceed supply, with contacts reporting double-digit increases in rents in most parts of the UK.

Overall, the last two years has had a positive effect on the residential property market, depending on the region. Recent UK House Price Index data shows the average transacted house price in April 2022 was £281,161 (compared to £278,436 in March) with a 1.1% rise compared to the previous month and a change of +12.4% compared to the same month the previous year. Whilst there is still an upward trend, the level of increase has been softening over the last couple of months.

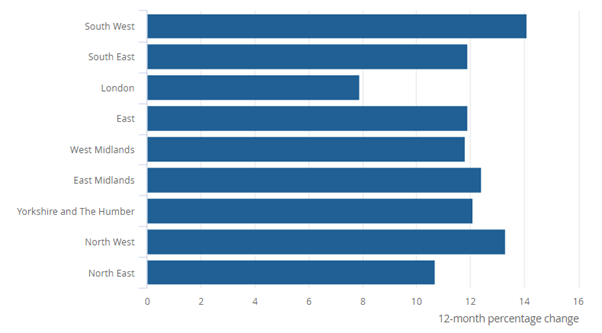

However, most of the increase in house price is driven by areas outside London, with London again being the region with the lowest annual growth:

We understand from the Office of National Statistics (ONS) that private rental prices paid by tenants in the UK rose by 2.8% in the 12 months to May 2022, up from 2.6% in the 12 months to April 2022. Private rental prices grew by 2.8% in England, 1.9% in Wales and 3.1% in Scotland in the 12 months to May 2022. The East Midlands saw the highest annual growth in private rental prices (4.1%), while London saw the lowest (1.5%).

London’s lacklustre rental price growth reflects a decrease in demand in part caused by a shift in housing preferences. This change in preference has been driven by an increase in remote working where workers no longer need to be close to the office. It also reflects an increase in supply, such as an excess supply of rental properties, as short-term lets change to long-term lets.

The Buy-to-Let market

As previously reported, the UK Government held a consultation between July and October 2019 on their plans to repeal section 21 of the Housing Act 1988 and amend the section 7 eviction process. The Government has committed to abolish ‘no-fault’ section 21 evictions in the private rented sector. A Renters’ Reform Bill was promised in the 2019 Queen’s Speech to achieve this. It is designed to give tenants more security of tenure over the property they rent. Landlords will not be able to evict tenants “without good reason” such as the landlord wishing to occupy the property themselves or sell it. While this will be welcome news for many tenants, many landlords may well see this as another burden.

Furthermore, Banking regulations have become tighter for buy-to-let lending with the introduction of Bank of England reporting requirements, Prudential Regulation Authority underwriting standards and further PRA changes. Along with the 3% increase in stamp duty levels for “additional properties” this has led to many private landlords being driven away from the sector and has limited the money-making potential of others.

Both the changes stated above, along with the increase in interest rates, mean buy-to-let investors are currently facing an uphill struggle.

Stay in the know

While the outlook may currently be bleak, we know how important it is to stay up-to-date with how things are progressing. Get our expert insights as they are published. Signup to the Quarterly RICS Chartbook and receive future analysis directly to your inbox.

If you would like to discuss how anything we have reported on may affect you, please call our experts on 0800 071 5517 or email admin@awh.co.uk.