Helping our clients understand how changes in the property market might affect them is extremely important to us here at Anderson Wilde & Harris. Below you can find our latest expert analysis of property market. Some of this analysis will have been published in the latest Quarterly RICS Chartbooks.

The UK Property Market at a glance

With rising utility costs and an increase in mortgage rates, affordability has become a key issue and we expect the headwinds of higher interest rates, high inflation and the cost of living crisis to converge, ultimately resulting in a reduction of real estate values. Although house prices have been reported to be softening in recent months, more recent news suggest that the beginning of 2023 has resulted in a strong ‘new year bounce’. We do however expect values to continue to decline into the first half of next year. The outlook beyond that is dependent upon whether interest rates continue to rise, how severe the predicted UK recession will be and whether the labour market significantly loosens.

The Bank of England again increased interest rates at the start of February to 4.0%. The Office of National Statistics (ONS) found gross domestic product (GDP) is estimated to have fallen by 0.5% in December 2022, following an unrevised growth of 0.1% in November 2022. Looking at the broader picture, GDP was flat in the three months to November 2022.

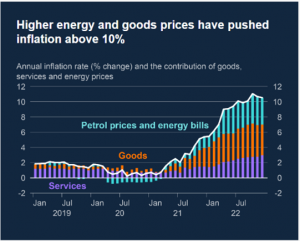

As at the middle of February 2023, inflation rate was recorded at 10.5%, down from the 11.1% recorded at the start of the month. The latest Monetary Policy Report (February 2023) states inflation has started to fall but acknowledges it is still much higher than their target of 2%.

The Bank of England expects inflation to move to around 11% towards the end of the year and subsequently fall back early next year as previous increases in energy prices drop out of the annual comparison. CPI inflation is projected to fall sharply to some way below the 2% target in two years’ time, and further below the target in three years’ time.

The latest Bank of England Agents’ summary of business conditions (2022 Q4) reported economic activity weakened modestly, with uncertainty around the outlook and a squeeze on incomes that hindered consumer demand. Although recruitment difficulties eased, nominal wage inflation ranged from 5% to 7%. And whilst inflation remains high, it has been difficult for companies to further increase prices.

A downturn in construction

Turning to the construction industry, construction output fell as home renovations declined sharply and commercial development weakened. Housing market activity continued to cool, and development and transaction activity for commercial property remained weak. The report found higher borrowing costs and concerns about affordability had weighed significantly on demand from first-time buyers. House viewings had fallen sharply and most offers were now below the asking price, as the supply of homes for sale increased faster than demand. Contacts of the Bank of England expect the market to continue to weaken next year. However, the supply of rental properties fell while demand increased, boosting rent inflation.

Contacts within commercial property said that higher borrowing costs, financial market volatility and high construction costs had weighed on investor demand for commercial property in recent months. As a result, values had fallen for all types of commercial property. Tenant demand for office space continued to fall although demand for prime office space remained high. Occupancy rates for retail property held steady and demand for industrial property continued to outstrip supply.

House prices drop for first time in recent months

The last two years has had a positive effect on the residential property market, depending on the region, however latest data shows the first drop in house prices in recent months.

The most recent UK House Price Index data – which only shows data to November – shows the average transacted house price at that time was £294,910 (compared to the October average of £296,422). Property prices have moved -0.3% compared to the previous month but risen by 10.3% compared to the previous year. In comparison October saw a +9.5% year on year change, which shows softer growth than what was experienced in earlier months. For England in particular the average house price was £315,000, which was a 10.9% increase on the previous year.

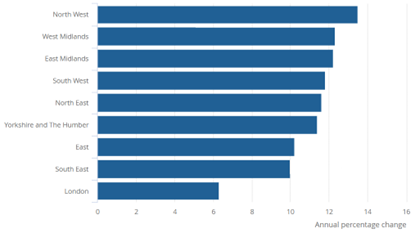

The North West saw the highest annual percentage change in the year to November 2022 (13.5%), while London saw the lowest (6.3%) of all English regions:

Whilst not visible when simply looking at the above graph on its own, comparing it to last month’s graph, the West Midlands suffered a modest reduction in annual percentage inflation compared to the previous month whilst the East, South West, Yorkshire and the Humber and the South East showed good growth.

We understand from the ONS that private rental prices paid by tenants in England rose by 4.1% in the 12 months to December 2022. The East Midlands saw the highest annual percentage change in private rental prices (5.10%), while London saw the lowest (3.8%).

London’s lacklustre rental price growth reflects a decrease in demand as remote working has shifted housing preferences with workers no longer needing to be close to offices.

Challenges faced in the Buy-To-Let Market

Banking regulations have become tighter for buy-to-let lending with the introduction of Bank of England reporting requirements and Prudential Regulation Authority underwriting standards and further PRA changes. Along with the 3% increase in stamp duty levels for “additional properties” this has led to many private landlords being driven away from the sector and has limited the money-making potential of others.

Additionally, it has been confirmed the Renters Reform Bill will be introduced. The white paper outlines proposals to abolish section 21 evictions and introduce a simpler, more secure tenancy structure. A tenancy will only end if the tenant ends it or if the landlord has a valid ground for possession. The grounds for possession will be reformed to ensure landlords have effective means to gain possession of their properties when necessary. New grounds will be created to allow landlords to sell or move close family members into the property. Grounds concerning persistent rent arrears and anti-social behaviour will be strengthened.

These changes, along with the increase in interest rates, mean that we are looking at a bleaker outlook for buy-to-let investors, although this may in part be cushioned by rising rents.

Stay up to date

We publish experts insights on a quarterly basis, released alongside the RICS Chartbook. Sign up today to receive these updates straight to your inbox.

To speak to one of our property experts about anything you have read above, please call 0800 071 5517 or email admin@awh.co.uk.